City of Scottsdale “Truth in Taxation” notice

This "Truth in Taxation" hearing notice regarding the City of Scottsdale primary property tax levy is being published as required by Arizona state law in the Arizona Republic on Tuesday, May 27, 2025, and Tuesday, June 3, 2025.

A public hearing on Scottsdale's proposed property tax levy will occur before final budget adoption, scheduled at 5 p.m. Tuesday, June 10, 2025, at Scottsdale City Hall, 3939 N. Drinkwater Blvd.

Meetings are broadcast electronically through Cox Cable Channel 11 and streamed online atScottsdaleAZ.gov (search “live stream”). To find the agenda for this meeting and information about the opportunity for public participation and comment, visit ScottsdaleAZ.gov and search “City Council agenda”.

The City of Scottsdale plans to increase its proposed primary property tax levy $5,408,904 (excluding new construction) due to tort liability claim payments, the 2 percent statutory adjustment, and adjustment for the impact from the Qasimyar versus Maricopa County tax judgement. If adopted by the City Council, the proposed primary property tax rate will increase from $0.4958 per $100 of assessed valuation to $0.5525 in Fiscal Year 2025/26.

The city's proposed secondary property tax levy will increase $0.01 million due to the use of fund balance accumulated in FY 2024/25 as a result of savings achieved through a prior year general obligation debt refinancing, and the current secondary tax rate of $0.4358 is expected to decrease by $0.0125 to $0.4233 per $100 of assessed valuation in FY 2025/26.

In Fiscal Year 2025/26, citizen tax bills will reflect a proposed combined property tax rate of $0.9758, which is $0.0442 higher than the Fiscal Year 2024/25 combined rate of $0.9316.

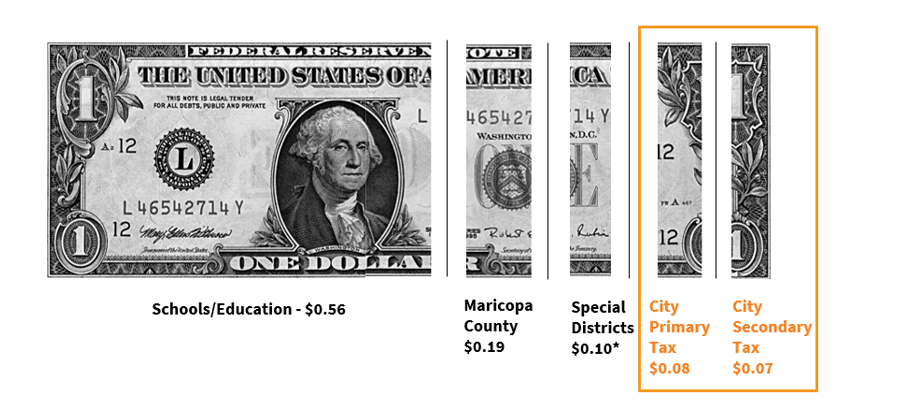

Where do your property taxes go in Scottsdale?

Primary property taxes are used by the City of Scottsdale to pay for city services and operational expenses and comprise about 10% of Scottsdale's General Fund operating budget.

Secondary property taxes based on limited assessed property values are restricted to pay debt service on voter-approved general obligation bonds for such things as parks, libraries, streets, and police/fire stations.

*Excludes street lighting districts, which vary by geographical location, types of lights, and City vs. HOA ownership.

Truth in Taxation Hearing: Notice of Tax Increase

In compliance with section 42-17107, Arizona Revised Statutes, the City of Scottsdale is notifying its property taxpayers of Scottsdale’s intention to raise its primary property taxes over last year’s level. Scottsdale is proposing an increase in primary property taxes of $5,408,904 or 13.64 percent.

For example, the proposed tax increase will cause Scottsdale’s primary property taxes on a $100,000 home to be $55.25 (total proposed taxes including the tax increase). Without the proposed tax increase, the total taxes that would be owed on a $100,000 home would have been $49.58.

This proposed increase is exclusive of increased primary property taxes received from new construction. The increase is also exclusive of any changes that may occur from property tax levies for voter approved bonded indebtedness or budget and tax overrides.

All interested citizens are invited to attend the public hearing on the tax increase that is scheduled to be held on Tuesday, June 10, 2025, at 5:00 p.m., at the City of Scottsdale City Hall Kiva, 3939 N. Drinkwater Blvd., Scottsdale, Arizona.

The meeting will also be broadcast electronically through Cox Cable Channel 11 and streamed online at ScottsdaleAZ.gov. Please check the City Council website at https://www.scottsdaleaz.gov/council/meeting-information/agendas-minutes for the specific agenda for this meeting and the latest updates regarding meetings and the opportunity for public participation and comment at this meeting.